March 26, 2024

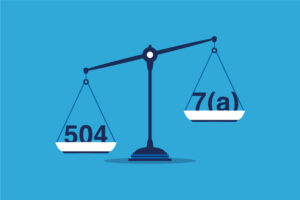

Which loan is right for my business — SBA 504 or SBA 7(a)?

Both SBA 504 and 7(a) allow for 90+% financing and a term/amortization for up to 25 years. And while SBA 7(a) is the primary loan option for projects involving working capital, trucks, and goodwill, SBA 504 is usually the superior financing choice for owner-occupied real estate and heavy machinery.

![Untitled-3 [Recovered] Untitled-3 [Recovered]](https://www.communitybusinessfinance.com/wp-content/uploads/2024/03/Untitled-3-Recovered-1-scaled.jpg)

Small business owners should evaluate their objectives carefully when considering SBA loans. Whether aiming to acquire property, equipment, or seeking working capital, consulting with a knowledgeable lending partner like Community Business Finance can help identify the best financing option to support their growth and success. Call us today to get started on your business dreams!